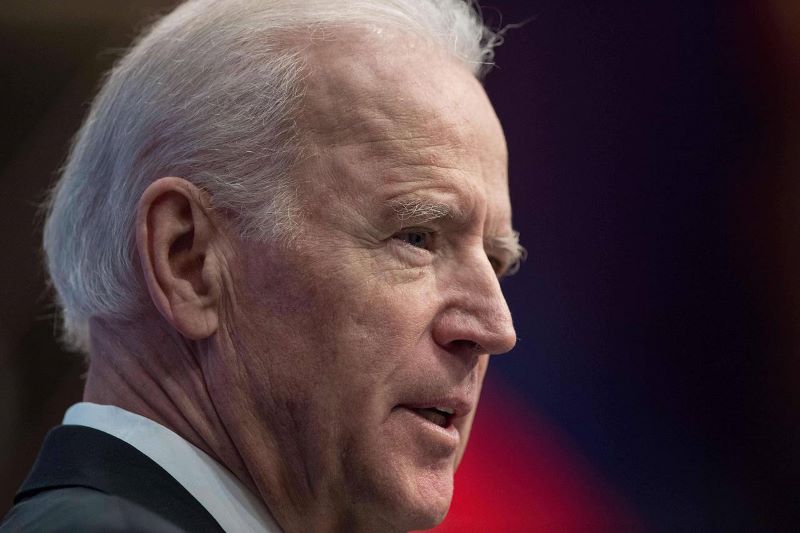

Inflation persists stubbornly high as the U.S. edges nearer to this fall’s presidential election. Should this trend endure, it could detrimentally impact President Joe Biden’s favor among voters—and the potential returns of investors.

Rising Inflation Raises Concerns

The consumer price index for March indicated a higher-than-anticipated increase in core inflation on a monthly basis. This spells trouble for investors anticipating interest rate reductions in the near future, as well as for consumers hoping for relief from the ever-mounting cost of living.

“More than half of the surge in CPI can be attributed to gasoline and rents, which are maintaining inflation above 3%,” remarks Jamie Cox, managing partner at Harris Financial Group.

Ripple Effects Across Society

Undoubtedly, this affects a wide swath of Americans; for instance, urban commuters reliant on public transit may lack a vehicle to fuel, yet they are more inclined to lease apartments than own residences. Furthermore, elevated oil prices could trigger ripple effects extending beyond eventual pain at the pump.

Jason Pride of Glenmede highlights the dual role of energy: a household expense and a foundational component in production costs.

Energy expenses not only impact households directly but also influence the cost structure of manufacturing and transportation, affecting consumers. Pride underscores that energy’s significance extends beyond household budgets, potentially shifting its burden onto consumers through manufacturing and transportation costs.

Electoral Impact of Economic Woes

Consequently, prolonged high inflation spells trouble for President Biden’s prospects for reelection. Americans experiencing a dissonance between the positive economic reports they encounter and the growing strain on their finances are likely to vent their frustrations on the president.

Nevertheless, recent years have taught us to anticipate the unexpected, and the outcome of the White House race remains uncertain.

Market Turbulence Ahead

Market volatility persists due to the perennial presence of uncertainty, a phenomenon echoed by both parties securing their nominations. Despite nominations being secured, the market remains jittery with the impending election casting a shadow over investor sentiment. Benson Durham from Piper Sandler observes that the election’s influence on market sentiment intensifies as voting day approaches despite party nominations.

Moreover, investors have cause for apprehension, as data indicates that market movements will hinge on the November victor.

Predictions and Projections

Durham’s analysis reveals that the yield curve on two- and 10-year U.S. Treasuries tends to flatten when President Biden’s perceived odds of reelection rise, whereas it steepens when markets perceive an increased likelihood of his defeat.

Regarding stocks, Durham’s analysis suggests that the S&P 500 would likely witness a 4.6% increase if Biden secures reelection, or a 3.1% decline if he were to lose, while controlling for other pivotal variables. “Durham’s analysis indicates that market fluctuations correlate with Biden’s reelection odds, impacting both bonds and stocks,” said WSJ Print Delivery.

Unforeseen Variables

Durham, despite his meticulous considerations, underscores the persistent unpredictability, cautioning against over-reliance on his conclusions due to unforeseen variables. While Durham endeavors to factor in diverse elements, he emphasizes the dynamism of investor sentiment and the market’s predictive nature.

He recognizes that markets may adjust preemptively if a collective expectation materializes, complicating predictive accuracy, tempering his insights. While Durham’s analysis is comprehensive, the inherent limitations of available data circumscribe it, urging prudence in interpreting his findings.

Nonetheless, his prognostications provide investors with some direction as they endeavor to position themselves for the forthcoming months. In a period when numerous Americans are fraught with anxiety regarding the election, clear insights may seem more valuable than gold.

Get a 2-year subscription to WSJ and Barron’s News, compatible with iOS, Android, PC, and Mac. Enjoy unlimited access to both publications, including Peggy Noonan’s insights, expert stock picks from Barron’s, WSJ live TV, audio articles, and Barron’s magazine. Subscribe now to stay informed with the latest news and valuable content!

Subscribe by calling the WSJ Phone Number: (800) 581-3716